Data Centre Race in South Africa: What AWS, Huawei, and Microsoft Know That You Don’t

The Data Centre Race in South Africa

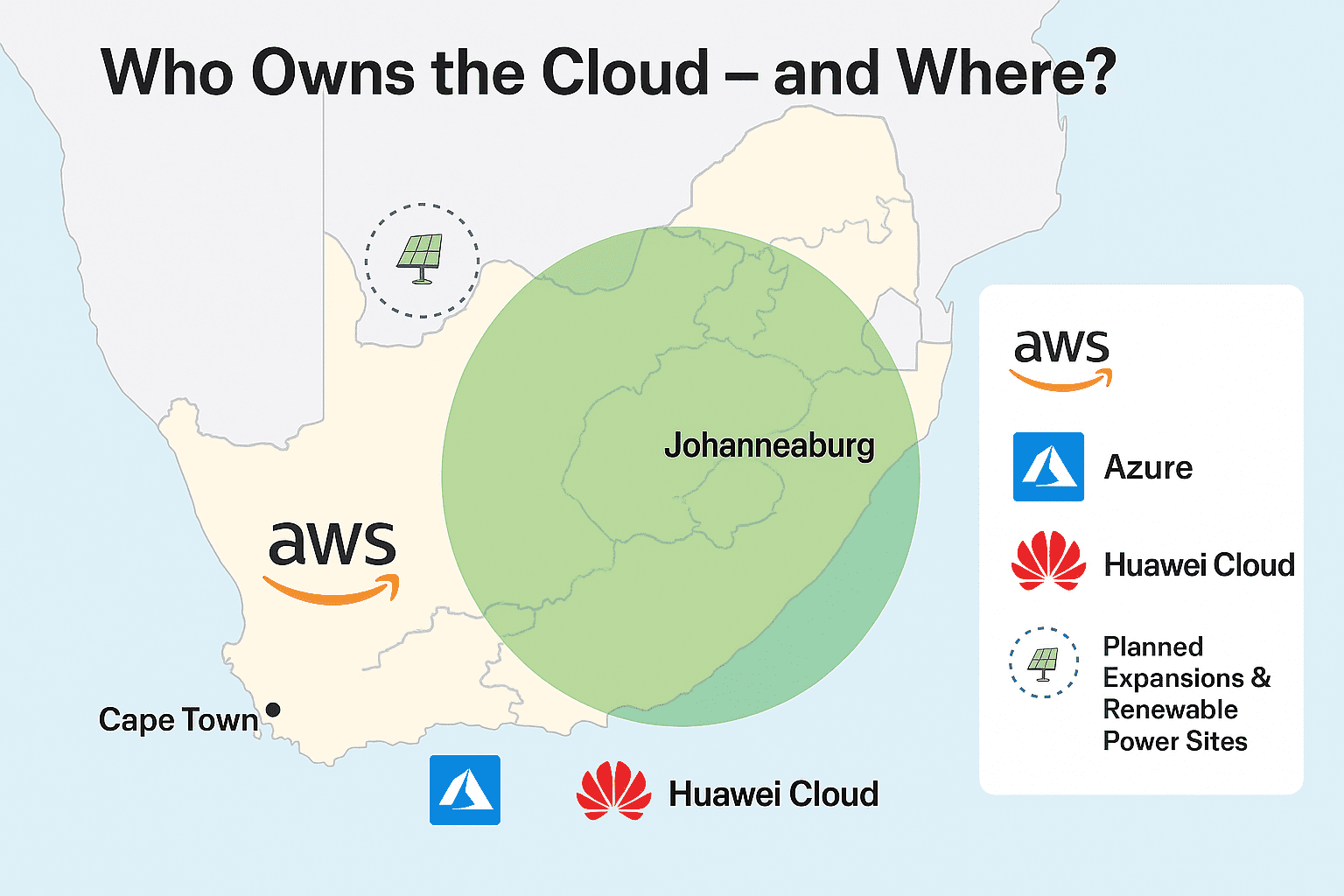

South Africa has become the primary battleground for global tech giants investing in Africa’s cloud infrastructure and Data centers. Amazon Web Services (AWS), Microsoft Azure, and Huawei Cloud have each launched local Data Centers — and they’re not doing it out of goodwill.

The explosion of Africa’s digital economy, data residency laws, and demand for low-latency services has made South Africa the logical entry point. With robust legal frameworks, a developed financial sector, and rapid SaaS growth, the country is at the heart of the continent’s cloud revolution.

Cloud Infrastructure by the Numbers (SA 2025)

SA Cloud Market Snapshot

| Metric | Value |

|---|---|

| Total Cloud Infrastructure Investment (2020–2024) | R58 billion+ |

| CAGR in Cloud Adoption (2021–2025) | 19% |

| JSE-listed Companies Using Cloud | 85% |

| CIOs Prioritising Cloud in IT Strategy (2025) | 91% |

| Jobs Created by Data Centres (Direct & Indirect) | 11,000+ |

Sources: Xalam Analytics, BCG Africa, Accenture SA, BusinessTech, Microsoft SA

The Key Players: AWS, Microsoft Azure & Huawei Cloud

Microsoft Azure: The Early Mover Microsoft was the first global hyperscaler in SA, launching data centres in Johannesburg and Cape Town in 2019. It has since become the go-to cloud provider for government, banks, and telcos.

Key Clients:

- Nedbank: migrated 60+ legacy systems to Azure

- SA Revenue Service (SARS): runs tax processing

- Vodacom: backend infrastructure and business automation

Case Study: Nedbank

- Reduced infrastructure costs by over R100 million annually

- Cut data processing times by 30%

- Enabled real-time risk modelling and AI-based credit decisions

Microsoft has also worked with local developers and startups through initiatives like the Microsoft Africa Development Centre, training over 1,000 local software engineers since 2021. Their contribution extends beyond infrastructure into skills development and digital inclusion.

Amazon Web Services (AWS): The Fintech Favourite AWS launched its Africa Region in Cape Town in 2020, with three availability zones and a Johannesburg expansion on the horizon. AWS is the preferred choice for scalable, developer-friendly infrastructure.

Key Clients:

- Capitec Bank: core banking and digital onboarding

- Showmax: video streaming and analytics

- Takealot: logistics and serverless computing

Case Study: Capitec Bank

- Uses AWS Lambda and EC2 for load balancing

- Cloud-native fraud detection systems

- 40% faster customer onboarding via mobile

AWS also powers several South African startups through its Activate programme, which grants up to $100,000 in cloud credits. Local AI startups in healthcare and agritech are scaling faster using these resources.

Fun Fact: AWS operates a 10MW solar plant in Northern Cape for its data centre needs.

Huawei Cloud: The Cost-Effective Challenger Huawei is expanding fast with a focus on affordability, AI, and public sector projects.

Why Huawei Appeals:

- 30–40% lower pricing

- Localised onboarding and support

- Strong edge computing and AI capabilities

Emerging Use Case:

- Municipal utilities in Limpopo using Huawei Cloud to run smart grid pilots, using AI to predict outages and reduce theft

Huawei has partnered with universities like the University of Johannesburg to establish smart classrooms and hybrid learning platforms, which now support over 20,000 students. This blend of infrastructure and academic support has helped bridge the digital divide.

Why Local Data Centres Matter

Benefits of Hosting Locally

- Faster application response times (low latency)

- Compliance with POPIA and sectoral regulations

- ZAR-based pricing

- Improved disaster recovery

- Enhanced security and data control

POPIA (Protection of Personal Information Act) requires that personal data of South Africans be stored in secure, locally managed environments. Local cloud zones help organisations meet these regulations with confidence.

Government Incentives & Regulatory Tailwinds

- FSCA requires stringent cloud controls in finance

- National Treasury Cloud Mandate encourages public cloud adoption

- DTIC offers tax rebates for cloud infrastructure investment

- ICASA spectrum auctions driving faster broadband

These efforts are creating a pro-cloud regulatory environment, ensuring continued momentum.

Key Sectors Moving to Cloud

Cloud Adoption by Sector

| Sector | Key Examples | Use Cases |

| Finance | Capitec, Nedbank, Discovery | Core systems, fraud AI, onboarding |

| Retail & eComm | Takealot, Mr Price | Dynamic pricing, mobile apps, logistics |

| Telecoms | Vodacom, MTN, Cell C | Billing systems, AI for speech analytics |

| Government | SARS, local municipalities | Tax processing, smart utilities |

| Education | Universities, Huawei Smart Classrooms | Digital learning platforms, backups |

Emerging Trends (2025–2028)

Top 5 Cloud Trends for SA Business

| Trend | Implication for Business |

| Multi-cloud strategy | Reduces vendor lock-in, boosts agility |

| Sovereign cloud | Ensures POPIA compliance |

| Edge computing | Enables smart cities and real-time AI |

| Green hosting | Aligns with ESG targets |

| Cloud-native security | Stronger encryption and access control |

Additional Trend: AI-Powered Analytics With real-time processing capabilities from cloud platforms, companies are leveraging AI to make faster business decisions. For example, Discovery Health uses cloud AI models for dynamic risk assessments in healthcare claims.

Challenges to Cloud Adoption

- Load shedding remains a threat; most providers now invest in backup solar and diesel

- Shortage of certified cloud engineers inflates labour costs

- Ransomware and cyberattacks are increasing (19% YoY)

- Migration from legacy systems can be expensive and complex

Tip: SMEs should take advantage of cloud credits from AWS and Microsoft to reduce onboarding costs.

Workforce Impact Cloud computing isn’t just reshaping technology infrastructure — it’s also changing how and where people work. Remote-first policies, enabled by scalable cloud collaboration tools, are helping companies reduce real estate costs and expand their talent pool. According to Microsoft SA, 72% of organisations say cloud was critical to enabling remote work.

The Rise of Colocation Facilities In parallel to hyperscaler investments, companies like Teraco and Africa Data Centres are investing in neutral colocation sites. These facilities allow smaller enterprises to benefit from cloud adjacency without the cost of full hyperscaler migration. Teraco’s NAPAfrica IXP (Internet Exchange Point) now handles over 2Tbps of traffic daily, making it the largest on the continent.

Final Word: Is Your Business Cloud-Ready?

The global cloud war is being fought and won in South Africa. Microsoft, AWS, and Huawei have each staked their claims, and local businesses now stand at a turning point.

Companies that adopt a smart, compliant cloud strategy will scale faster, serve customers better, and innovate more freely. Those that don’t may be left behind in an increasingly digital marketplace.

Start with a cloud-readiness assessment, engage your IT and compliance teams early, and map your migration strategy in phases. Whether you’re an SME or a large enterprise, cloud is no longer optional — it’s foundational.