Takealot Launches Home Loan Hub in S.A

Takealot Launches Home Loan Hub in S.A

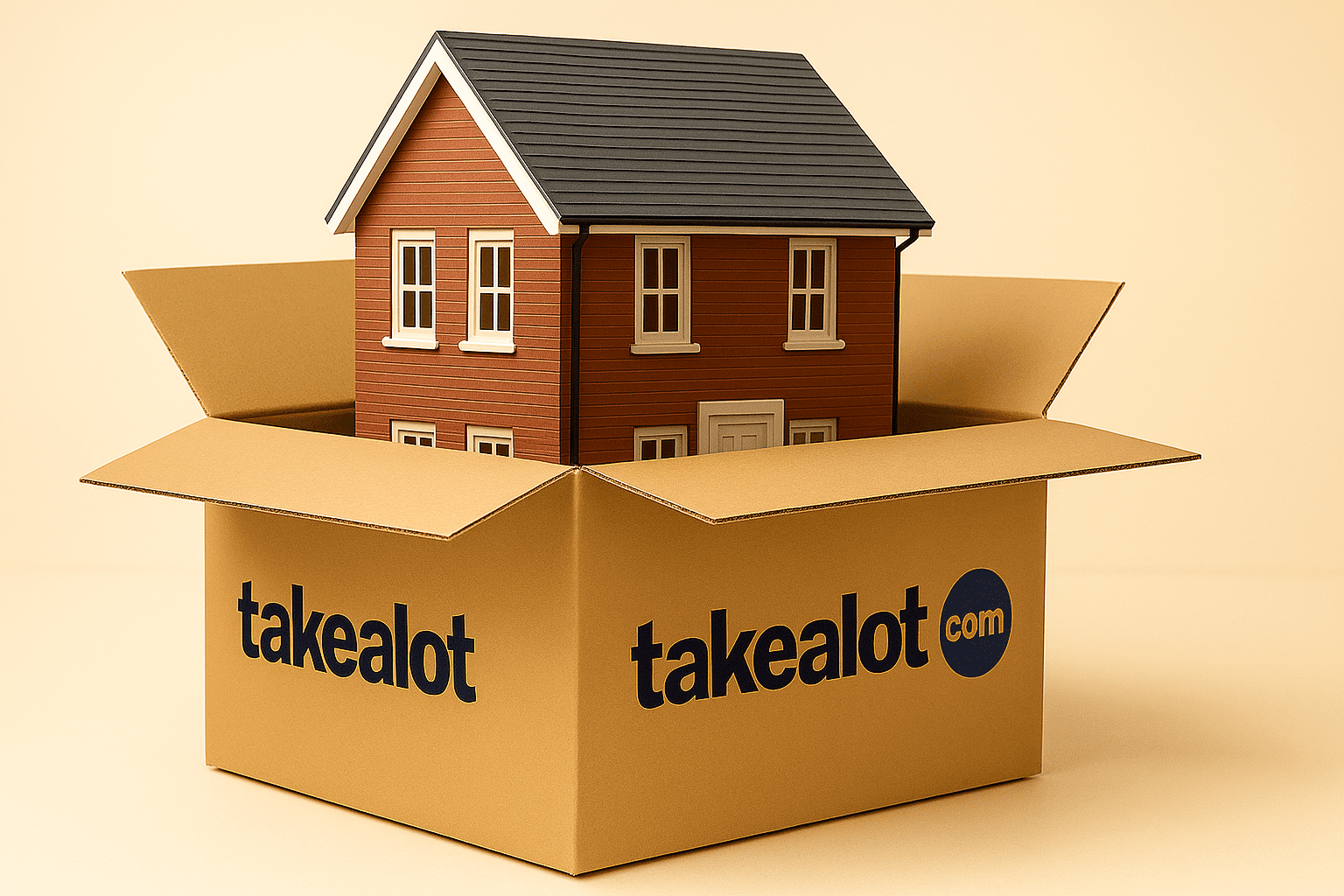

South Africa’s biggest online retailer, Takealot, has expanded beyond electronics, groceries, and daily essentials—this time moving into the world of property finance. The e-commerce giant has officially launched a Home Loan Hub, a digital platform that allows South Africans to apply for and compare home loans online.

In partnership with MortgageMarket, Takealot aims to revolutionise the way buyers secure bonds, making the process as simple and intuitive as adding an item to a shopping cart.

A Bold Step Into Fintech

Takealot is no stranger to diversifying. From books and gadgets to groceries and even pharmaceuticals, the company has consistently broadened its offerings. But its latest move into financial services signals a much bigger play: capturing South Africans where it really matters—the housing market.

The Home Loan Hub is designed to simplify what has traditionally been a daunting process filled with paperwork, back-and-forths with banks, and long waiting times.

According to Takealot, the platform enables:

- One Application, Multiple Offers: Buyers can submit a single application and receive bond offers from multiple banks.

- Easy Navigation: The system mirrors Takealot’s signature e-commerce flow, giving users a familiar, hassle-free experience.

- Incentives for Early Users: Launch promotions include vouchers worth up to R20,000, further enticing South Africans to try the service.

Why This Matters for South Africans

1. Convenience Meets Property Finance

Traditionally, applying for a bond involves endless forms, manual submissions, and waiting periods. By digitising this process, Takealot is offering what banks and estate agents have long promised but seldom delivered: speed, transparency, and choice.

2. Leveling the Playing Field

Not all buyers are comfortable negotiating with multiple banks. Takealot’s platform allows borrowers to compare options side by side, helping them secure competitive interest rates without the pressure of face-to-face negotiations.

3. Trust in the Takealot Brand

As one of South Africa’s most recognised online companies, Takealot brings brand credibility to an industry that many find intimidating. Customers already shopping daily on the site may feel more confident extending that trust to property finance.

How It Works

The Home Loan Hub is powered by MortgageMarket, a digital mortgage facilitator that partners with major South African banks.

Here’s the step-by-step process:

- Log onto the Takealot Home Loan Hub (via the Takealot platform).

- Complete one online application with personal, financial, and property details.

- Receive offers from multiple banks, each with unique interest rates and terms.

- Compare side-by-side, much like checking product reviews or price comparisons.

- Select the preferred option and proceed to final approval directly with the lender.

This integration mirrors the convenience that has made Takealot South Africa’s most popular e-commerce marketplace.

The Bigger Picture: Takealot’s Fintech Ambitions

Takealot’s entry into the home loan space may be just the beginning of a broader fintech push. By partnering with financial service providers, the retailer is positioning itself not only as an online shopping giant but as a one-stop lifestyle platform.

This strategy echoes global trends:

- Amazon has experimented with insurance and lending products.

- Alibaba runs one of the world’s largest digital finance arms through Ant Group.

If successful, Takealot could follow a similar path—expanding into personal loans, insurance, and investment tools.

Challenges to Watch

While the idea is exciting, a few questions remain:

- Bank Participation: How many major banks are fully onboard? The more lenders involved, the better the choice for consumers.

- Data Privacy: Handling sensitive financial information requires top-tier security—something consumers will scrutinise closely.

- Support Systems: Unlike buying a toaster online, home loans involve significant legal and financial complexities. Will Takealot provide robust customer support?

What This Means for Home Buyers

For South Africans dreaming of owning a home, Takealot’s move could make the journey smoother and less intimidating. The benefits are clear:

- Faster bond application process.

- Easier comparison of bank offers.

- Potential cost savings through competitive rates.

- Added perks like shopping vouchers to sweeten the deal.

In a country where access to finance can often feel overwhelming, Takealot’s platform might become the go-to starting point for first-time buyers and seasoned homeowners alike.

Takealot’s launch of the Home Loan Hub marks a bold shift for South Africa’s e-commerce landscape. By blending shopping-style simplicity with property finance, the retailer is stepping firmly into fintech territory—challenging banks, estate agencies, and existing bond originators.

For South Africans, the move represents not just another Takealot service, but a potential game-changer in how bonds are applied for and approved. If successful, it could reshape the property market just as Takealot reshaped online retail.