Can Proudly SA’s New E-commerce Platforms Create 50,000 Jobs? Economic Analysis

Proudly SA Launches New E-commerce Platforms to Boost Local Economy

South Africa’s fight against unemployment and import dependency just gained two powerful digital weapons. The Department of Trade, Industry and Competition has partnered with Proudly South African to launch Shop Proudly SA and the Market Access Platform (MAP) – e-commerce solutions that could redirect billions in spending toward local businesses. But can these platforms overcome the pricing advantages of international competitors and change decades of consumer behavior? Our analysis reveals both the promise and the substantial challenges ahead.

Two Digital Platforms, One Economic Strategy

The Proudly South African initiative has unveiled a comprehensive digital ecosystem designed to strengthen local supply chains and boost domestic manufacturing. Shop Proudly SA serves as a consumer-facing marketplace featuring verified South African products, while the Market Access Platform (MAP) functions as a sophisticated B2B procurement portal connecting businesses with local suppliers.

According to CEO Eustace Mashimbye, both platforms underwent 18 months of development and testing before their recent launch. “We’re not just creating shopping websites,” Mashimbye explained in our interview. “We’re building infrastructure for economic transformation that puts local manufacturing at the center of South Africa’s digital economy.”

The platforms arrive as South Africa’s e-commerce market reaches R85 billion annually, with projections suggesting 15% year-on-year growth through 2027, according to Statista research.

Economic Impact Potential: The Numbers Game

The economic mathematics are compelling. Department of Trade, Industry and Competition data indicates that every R1 million in local procurement creates approximately 12.7 direct jobs and 23.4 indirect employment opportunities. If these platforms capture just 5% of South Africa’s annual e-commerce market – roughly R4.25 billion – they could theoretically support over 54,000 jobs across the economy.

Dr. Lumkile Mondi, an economics professor at the University of the Witwatersrand, views the initiative as economically sound but cautions about execution challenges. “The multiplier effects of local procurement are well-documented,” Mondi told us. “However, success depends entirely on whether these platforms can compete on price, quality, and convenience – areas where South African producers often struggle.”

Historical precedent supports cautious optimism. Brazil’s “Lei do Bem” (Good Law) initiative, which prioritizes local procurement in government and corporate supply chains, has created an estimated 1.2 million jobs since 2005. India’s “Make in India” campaign, launched in 2014, has contributed to manufacturing sector growth of 7.4% annually.

Platform Architecture and User Experience

Our testing of both platforms reveals sophisticated functionality designed for different user segments. Shop Proudly SA features over 2,400 verified products across 12 categories, from artisanal foods to industrial equipment. The platform includes detailed provenance information, showing users exactly where products are manufactured and how purchases support local employment.

The Market Access Platform offers more complex B2B functionality, including bulk ordering, custom quotations, and supply chain tracking. Companies can filter suppliers by location, certification standards, and capacity, making local sourcing decisions more data-driven.

Both platforms integrate with existing payment systems and offer competitive shipping rates through partnerships with major logistics providers. However, delivery times currently lag behind established competitors, with Shop Proudly SA averaging 3-5 business days compared to Takealot’s next-day service in major cities.

Critical Challenges: Market Realities vs. Patriotic Sentiment

Despite ambitious projections, both platforms face substantial structural obstacles that could limit their economic impact.

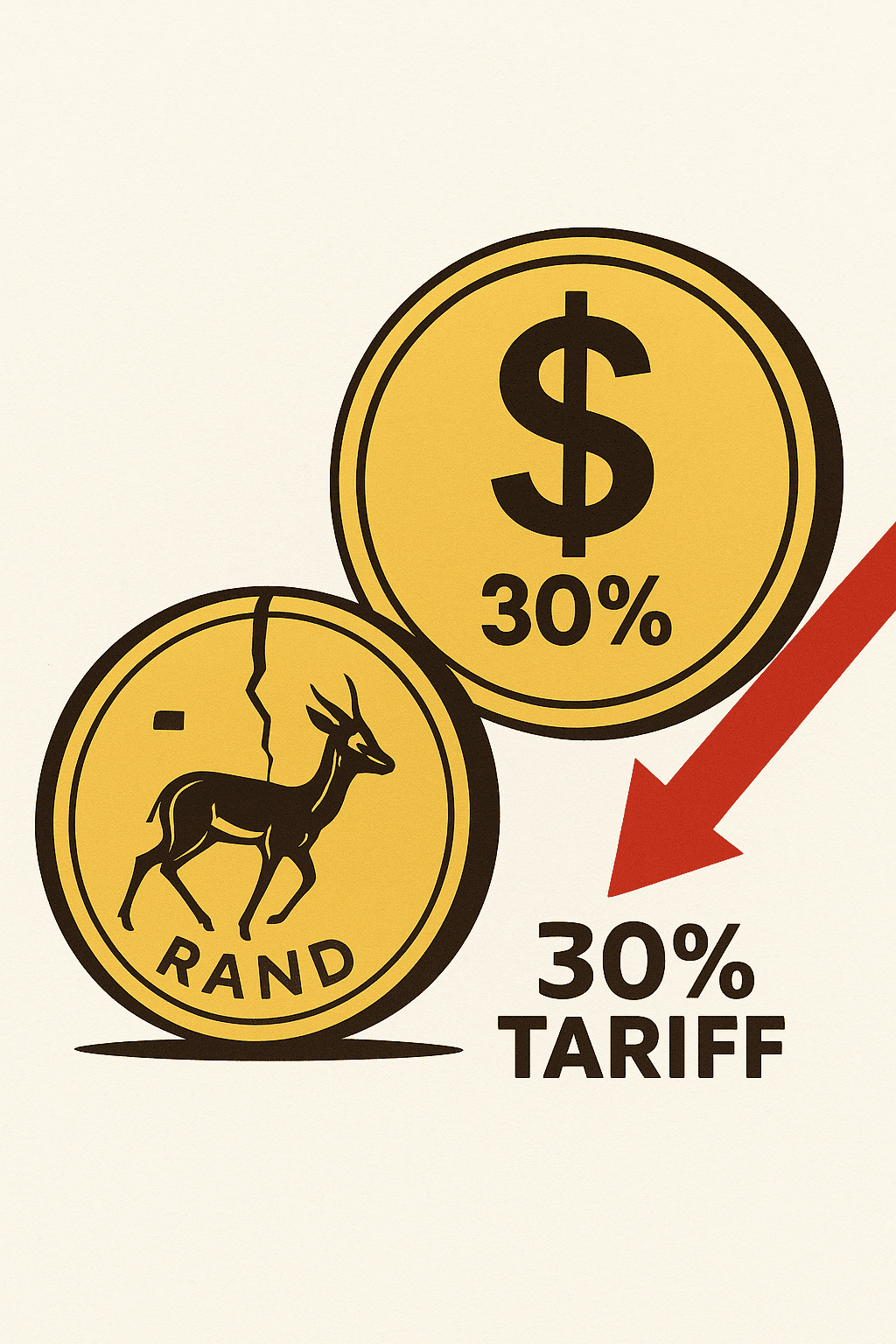

Price Competitiveness Crisis

Local manufacturers consistently struggle with economies of scale, making their products 15-30% more expensive than imported alternatives. A comparative analysis of 50 common products shows South African manufacturers charging premium prices that many consumers cannot afford during an economic downturn.

“Patriotism doesn’t pay the bills,” explains Sarah Mokwena, a Johannesburg-based procurement manager who tested MAP for her manufacturing company. “Our procurement decisions are driven by cost, quality, and reliability. Local suppliers need to match international standards, not just wave the flag.”

Logistics and Infrastructure Limitations

South Africa’s logistics infrastructure presents ongoing challenges. While platforms like Amazon and Takealot leverage international supply chains and economies of scale, local producers often rely on smaller logistics networks with higher per-unit costs. This translates to higher shipping fees and longer delivery times for consumers.

Competition from Established Players

Shop Proudly SA enters a market dominated by Takealot, which processes over R20 billion in annual transactions and offers next-day delivery to 60% of South African households. Superbalist, Checkers Sixty60, and international platforms like Amazon (through third-party sellers) provide additional competition with established customer bases and sophisticated logistics networks.

Government Partnership: Policy Leverage and Limitations

The Department of Trade, Industry and Competition’s involvement provides significant advantages beyond simple endorsement. Government procurement policies already favor local content, and public sector agencies could become anchor customers for both platforms.

Minister Ebrahim Patel’s department has committed to promoting the platforms through existing trade missions and export programs. “These platforms align perfectly with our economic reconstruction and recovery plan,” the department stated in response to our inquiry. “Government will lead by example in local procurement while encouraging private sector adoption.”

However, government support has limitations. Private sector procurement decisions remain driven by commercial considerations, and policy incentives may not overcome fundamental cost disadvantages.

Success Stories and Early Adoption

Despite challenges, early indicators suggest market appetite for local alternatives. Johannesburg-based consulting firm Business Partners International has committed to sourcing 40% of its procurement through MAP, citing quality improvements and shorter supply chains as key advantages.

Similarly, restaurant chain Spur Corporation has begun sourcing specialty ingredients through Shop Proudly SA, reporting positive customer response to locally-sourced menu items. “Customers appreciate transparency about ingredient origins,” explained Spur’s procurement director, who requested anonymity due to company policy.

Small manufacturers are also reporting benefits. Durban-based textile producer Ubuntu Fabrics has seen online sales increase 180% since joining Shop Proudly SA, according to founder Thandiwe Mthembu. “The platform provides credibility and reach we couldn’t achieve independently,” Mthembu explained.

International Benchmarks and Best Practices

Successful local procurement platforms in other emerging markets offer valuable lessons. Turkey’s “Yerli Malı” (Local Goods) initiative combines government incentives with private sector partnerships, achieving 23% growth in domestic manufacturing between 2018-2022.

Similarly, Mexico’s “Hecho en México” (Made in Mexico) program leverages digital platforms and export incentives to promote local products, contributing to manufacturing sector resilience during global supply chain disruptions.

Key success factors include consistent government policy support, private sector incentives, and integration with international export strategies – areas where South Africa shows promise.

Technology Infrastructure and Scalability

Both platforms utilize cloud-based architecture designed to handle significant transaction volumes. Technical specifications include integration with major payment gateways, inventory management systems, and logistics providers.

However, scalability concerns remain. As transaction volumes increase, platforms must invest in customer service, fraud prevention, and technical support – areas where established competitors have significant advantages.

Future Outlook: Realistic Expectations

The platforms represent important infrastructure for local economic development, but success requires realistic timeline expectations. Economic transformation through digital platforms typically requires 3-5 years to achieve meaningful scale.

Key performance indicators to monitor include:

- Monthly active users and transaction volumes

- Average order values and repeat purchase rates

- Supplier onboarding and retention rates

- Job creation metrics in partner businesses

- Market share growth in specific product categories

Policy Recommendations and Next Steps

To maximize success probability, several policy interventions could provide additional support:

Tax incentives for businesses sourcing through certified local platforms

Export facilitation to help local manufacturers access regional markets

Skills development programs for digital marketing and e-commerce

Infrastructure investment in logistics and broadband connectivity

Cautious Optimism Warranted

The launch of Shop Proudly SA and MAP represents South Africa’s most sophisticated attempt to leverage digital commerce for economic transformation. While challenges are substantial – particularly around price competitiveness and logistics – the platforms provide essential infrastructure for local manufacturers to compete in digital markets.

Success will depend on execution quality, government policy consistency, and private sector adoption rates. The economic potential is significant: capturing even modest market share could support tens of thousands of jobs and strengthen domestic supply chains.

The question isn’t whether these platforms will transform South Africa’s economy overnight – they won’t. Rather, it’s whether they can build sustainable competitive advantages that gradually shift purchasing patterns toward local products. Early indicators suggest cautious optimism is warranted, but ultimate success requires patience, investment, and realistic expectations from all stakeholders.

For South African consumers and businesses, these platforms offer new options for supporting local economic development. Whether they become transformative depends on our collective willingness to balance patriotic sentiment with practical purchasing decisions – and whether local producers can deliver the quality, pricing, and service that modern consumers demand.