Inflation Target Showdown

Inflation Target Showdown

A Policy Rift with Real-World Consequences

South Africans are no strangers to economic uncertainty. From load shedding to fluctuating fuel prices, citizens and businesses alike have learned to adapt to unpredictable financial terrain. But in mid-2025, a different kind of economic storm brewed—one not in the streets or markets, but in the corridors of power.

The South African Reserve Bank (SARB) announced it would unilaterally lower its inflation target from the long-standing 3–6% range to a fixed 3%, a move aimed at price stability. This decision, however, triggered an unprecedented public clash with the Finance Ministry, which warned that such an aggressive target could choke economic growth and stall job creation.

This disagreement isn’t just an elite policy debate—it has direct implications for households, small businesses, and investors.

What Sparked the Clash?

For decades, SARB has operated within a flexible inflation target, allowing policymakers to balance between controlling prices and supporting growth. But Governor Lesetja Kganyago’s announcement in July 2025 marked a sharp pivot:

“We must entrench price stability to restore public confidence in the rand and attract long-term investment,” Kganyago said.

Finance Minister Enoch Godongwana responded swiftly, cautioning that a sudden shift in inflation policy could increase borrowing costs, reduce fiscal flexibility, and push unemployment higher—already sitting at around 32%.

At the heart of the dispute lies the trade-off between monetary discipline and economic stimulus.

Why Inflation Targets Matter for South Africans

To most people, inflation is simply “the rising cost of living.” But to economists, it’s a multifaceted economic signal that affects everything from interest rates to wage negotiations.

Here’s why SARB’s move is significant:

- Lower Inflation = Lower Price Growth

If the target is strictly enforced, prices for essentials like food, fuel, and rent should rise more slowly. - Lower Inflation = Higher Interest Rates in the Short Term

To achieve a 3% target, SARB may need to keep rates higher for longer, making loans and credit more expensive. - Impact on Businesses

Small businesses reliant on credit could face higher financing costs, slowing expansion plans. - Impact on Job Creation

Stricter monetary policy can discourage investment, which in turn may reduce job opportunities.

The Economic Balancing Act: Growth vs Stability

Economies function best when inflation is stable and predictable. But “stable” doesn’t necessarily mean “low at all costs.”

South Africa’s economic structure is heavily dualised—with world-class financial institutions existing alongside informal, cash-dependent markets. In such an environment, too much emphasis on inflation suppression could:

- Reduce short-term demand for goods and services

- Increase inequality between formal and informal economies

- Slow down infrastructure investments that need low-cost borrowing

In other words, too much monetary discipline could unintentionally harm long-term growth.

Lessons from Other Countries

Other emerging economies have wrestled with the same dilemma:

- Brazil lowered its inflation target aggressively in the late 2010s, which initially boosted investor confidence but slowed growth for several years.

- India maintained a moderate target and instead focused on supply-side reforms, resulting in stronger growth despite moderate inflation.

The key takeaway? Inflation targeting works best when paired with structural reforms—without them, the benefits are limited.

Political Undertones and Institutional Independence

The SARB’s independence is enshrined in the Constitution. This means the Finance Ministry cannot directly overrule the decision. However, policy coordination is essential.

The Finance Ministry’s argument is not against price stability—it’s about timing and proportionality. With unemployment high and GDP growth forecast below 1.5% in 2025, the Ministry believes the economy needs a mix of fiscal stimulus and accommodative monetary policy, not tighter restrictions.

The tension here reflects a broader philosophical divide:

- SARB prioritises defending the rand and controlling inflation.

- Finance Ministry prioritises growth, jobs, and debt sustainability.

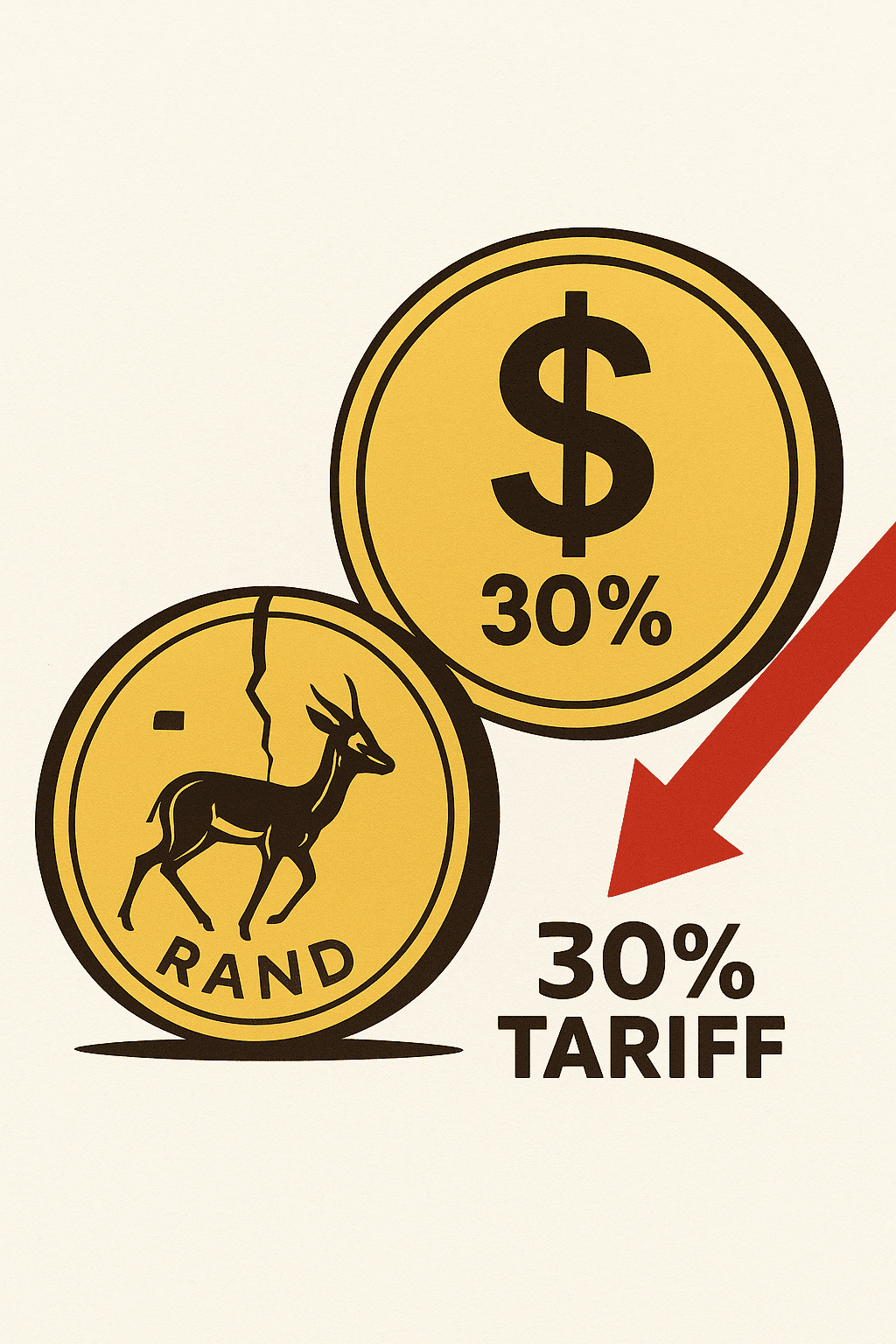

Impact on the Rand, Markets, and Investments

When the announcement was made, the rand strengthened slightly—a sign that currency traders welcomed the inflation-fighting stance. Bond markets also saw temporary inflows.

However, analysts warn that without clear communication, markets could interpret the public dispute as policy instability, which might trigger volatility in the currency and stock exchange.

Investors crave certainty, and mixed signals from government and central bank officials can undermine that confidence.

What It Means for Households

Let’s break down the likely impact for everyday South Africans:

- Home Loans & Vehicle Finance: Higher interest rates could mean bigger repayments for those with variable-rate loans.

- Food & Utilities: If the policy works, price hikes should slow, but global commodity shocks (like oil prices) could still offset gains.

- Savings & Investments: Fixed-income products like bonds may offer better returns in a high-rate environment.

- Employment: Companies might delay hiring until borrowing costs ease, making the job market more competitive.

Business Sector Reactions

Business groups are split:

- Export-oriented industries welcome a stronger rand, as it stabilises input costs for imported goods.

- Local manufacturers worry that high rates will curb domestic demand.

- Small and medium enterprises (SMEs)—already under pressure from load shedding and rising compliance costs—fear credit will become prohibitively expensive.

The South African Chamber of Commerce and Industry (SACCI) has urged both sides to find common ground to avoid sending mixed signals to the market.

Bridging the Gap: A Possible Middle Path

Many economists argue that the solution lies in phased implementation:

- Maintain a gradual inflation target reduction over several years, rather than a sudden shift.

- Pair monetary discipline with supply-side reforms—like improving port efficiency, reducing red tape for SMEs, and investing in skills training.

- Enhance communication between SARB and Treasury to reassure investors and the public.

This approach could balance price stability with economic resilience.

What the Public Thinks

On social media and community forums, opinions are divided.

- Some praise SARB for “standing firm” against inflation.

- Others accuse policymakers of being out of touch with the struggles of working-class households.

This public divide reflects a deeper issue: economic policy debates in South Africa often exclude those most affected by them.

More Than Just Numbers

The clash between SARB and the Finance Ministry is not just about an inflation percentage point—it’s about what kind of economy South Africa wants to build.

A purely low-inflation economy might please foreign investors but leave local entrepreneurs gasping for credit. A purely growth-focused economy might generate jobs in the short term but risk long-term instability.

The challenge for South Africa is finding a policy mix that protects the rand, supports growth, and uplifts its citizens—all at the same time. That will require not only economic expertise, but political courage, institutional cooperation, and above all, public trust.