SA GDP Stagnation: Why South Africa’s Economic Growth Keeps Underperforming

SA GDP Stagnation: Why South Africa’s Economic Growth Keeps Underperforming

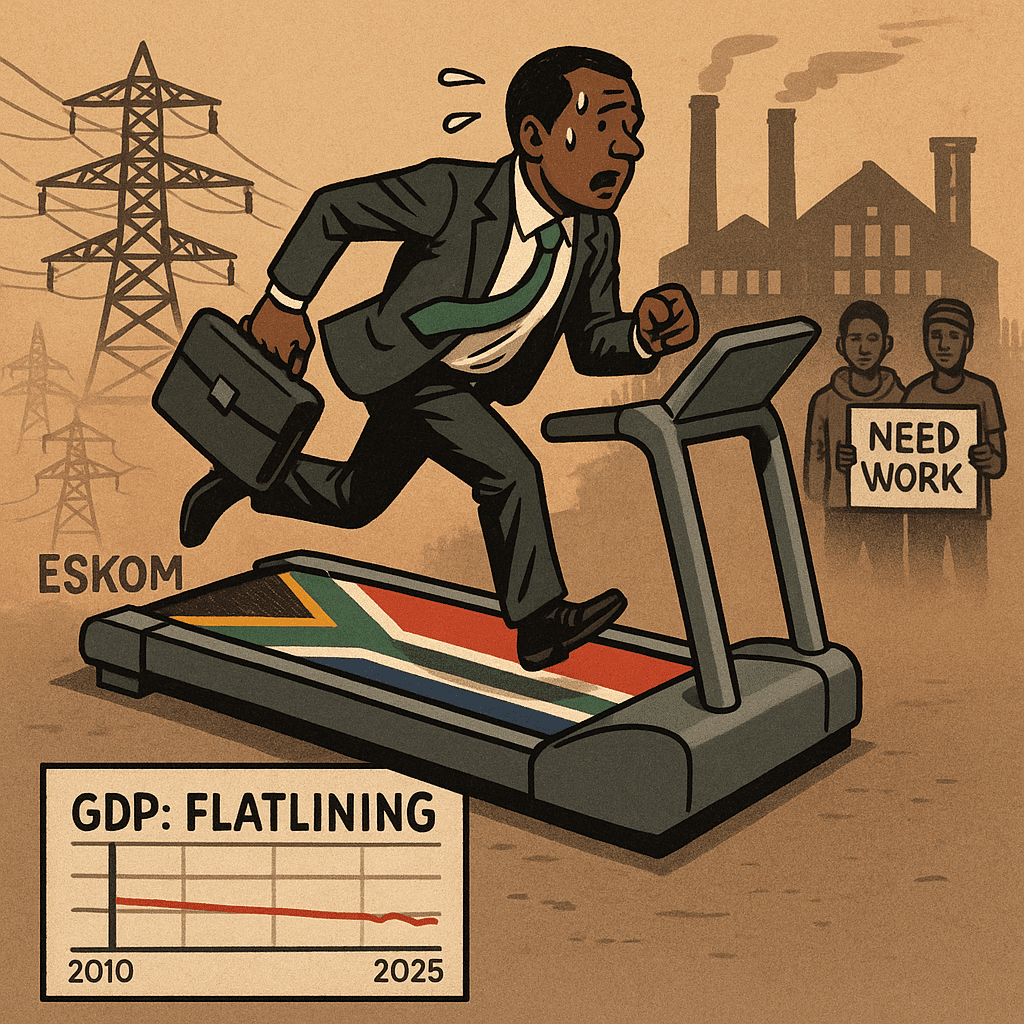

South Africa, a nation celebrated for its vast potential and sophisticated economic infrastructure, is facing a severe and prolonged period of economic stagnation. For business professionals and investors, understanding the root causes of this underperformance is essential for navigating the market. The country’s Gross Domestic Product (GDP) growth has been persistently weak for over a decade, a trend that is insufficient to create jobs for its growing population and is actively diminishing the wealth of its citizens.

This article delves into the core issues behind South Africa’s economic struggles, directly addressing the key questions on the minds of business leaders and analysts. We’ll explore the multifaceted reasons for this decline, from operational failures to policy missteps, and provide a clear-eyed perspective on the long-term economic outlook. The analysis will move beyond a superficial view, examining the interconnected nature of the challenges and the critical reforms needed to steer the economy toward a more prosperous future.

The Alarming Reality: Main Causes of South Africa’s Economic Stagnation

The low-growth environment in South Africa is not a simple problem with a single solution. It is the result of a convergence of deep-seated structural issues and a lack of decisive policy execution. The primary reasons for this stagnation can be clustered into four critical areas:

- Infrastructure Bottlenecks: The most significant and visible constraint is the collapse of the country’s essential network industries. This includes the electricity crisis at Eskom and the operational failures of Transnet, the state-owned rail and port operator. These failures have created severe supply-side constraints that directly limit economic output and raise the cost of doing business. The decay of these foundational services is a core reason why business confidence and investment have plummeted.

- Weak Business and Investment Environment: Policy uncertainty, coupled with high levels of corruption and inefficiency in state institutions, has eroded both domestic and foreign investor confidence. A lack of policy consistency, particularly in sectors like mining and energy, makes long-term capital commitments risky and unattractive. Investors require a stable and predictable regulatory framework to commit resources, and South Africa has failed to provide this consistently.

- High Unemployment and Inequality: With one of the highest unemployment rates in the world, South Africa’s economic growth is stifled by limited consumer demand. The deeply entrenched inequality, a legacy of apartheid, has been exacerbated by an economy that is not creating sufficient jobs for its population. This creates a vicious cycle where poverty and social instability deter investment. The Gini coefficient, a measure of income inequality, remains one of the highest in the world, a clear sign of the deep structural divides within the economy.

- Declining State Capacity: As noted by a Harvard Growth Lab report, the core reason for South Africa’s malaise is the collapsing capacity of the state itself. A lack of meritocracy in public appointments, counterproductive ideological policies, and an inability to empower the private sector to solve problems have collectively rendered essential government functions ineffective. The state’s inability to deliver on its mandate has become a primary obstacle to economic progress.

The Diminishing Average: Why South Africa’s GDP Per Capita is Declining

The decline in South Africa’s GDP per capita is a stark indicator of the nation’s economic struggles. This metric, which measures the average economic output per person, has been on a downward trend for over a decade. It reflects a nation where the “economic pie” is simply not growing fast enough to provide more for each individual, leading to a real erosion of the average citizen’s standard of living.

The primary reason is straightforward: the country’s population growth rate has consistently outpaced its economic growth rate. When the economy expands at less than the rate of population increase, the average wealth of the population inevitably falls. This decline is further compounded by:

- Slow Wage Growth and Inflation: Real wages in South Africa have not kept pace with inflation, meaning that even for employed individuals, purchasing power is diminishing. This restricts household consumption and hinders the growth of local businesses that rely on domestic demand.

- High Debt Levels: The government’s rising debt-to-GDP ratio puts immense pressure on public finances, limiting its ability to invest in services and infrastructure that could boost the economy and improve citizens’ lives. A significant portion of the national budget is now allocated to debt servicing, diverting funds from critical sectors like education, healthcare, and infrastructure.

- Ineffective Fiscal Policy: Due to the weak supply side of the economy, government spending has often had a negative multiplier effect, often leading to higher prices rather than meaningful growth. The inability to target spending effectively has resulted in limited returns on public investment.

Economic Paralysis: How Load Shedding Affects the South African Economy

Load shedding is arguably the single biggest drag on South Africa’s economic performance. Its impact is pervasive, affecting every sector of the economy from large-scale manufacturing to small businesses. It is not merely an inconvenience but a fundamental operational constraint that has severely crippled the nation’s productive capacity.

- Loss of Productivity and Output: Power cuts halt production lines, disrupt supply chains, and lead to lost operational hours. Industries like mining and manufacturing, which are heavily reliant on stable electricity, have seen their output plummet, weakening the nation’s export capacity. The unpredictability of these outages makes it virtually impossible for businesses to plan and execute operations efficiently.

- Increased Costs of Business: To cope with the outages, businesses must invest in expensive backup power solutions like generators or solar systems. These costs are often passed on to consumers or absorb capital that could have been used for expansion, innovation, and job creation. This adds a significant “tax” on every business operating in the country, eroding profit margins and making them less competitive.

- Dampened Investor Confidence: The unreliability of basic services like electricity makes South Africa a high-risk environment for investors. This uncertainty is a major deterrent for both domestic and foreign capital. A stable energy supply is a non-negotiable requirement for modern industrial and commercial operations, and South Africa’s failure to provide this has put it at a severe disadvantage.

- Damage to SMEs: Small and medium-sized enterprises (SMEs) are particularly vulnerable to the effects of load shedding. Many cannot afford backup power, leading to closures, lost revenue, and a lack of job security for their employees. This hits job creation where it’s needed most, as SMEs are often the engine of employment in developing economies.

The South African Reserve Bank (SARB) has estimated that the cumulative impact of load shedding has shaved a significant percentage off of the country’s potential GDP, highlighting its role as a key driver of economic underperformance.

Beyond the Symptoms: The Deeper Structural Failures

While load shedding and infrastructure decay are the most visible signs of economic distress, they are merely symptoms of a deeper structural malaise. For a complete understanding, we must examine the underlying issues that have enabled these failures.

- Ineffective Human Capital Development: Despite high unemployment, there is a significant skills mismatch in the labor market. The education and training systems are not producing the skilled workforce needed for a modern, knowledge-based economy. This results in businesses struggling to fill key roles, even with a vast pool of unemployed people, and perpetuates the cycle of joblessness and low productivity.

- Labor Market Rigidity: South Africa’s labor laws, while well-intentioned, are often criticized for their rigidity, which can make it difficult for businesses, especially SMEs, to hire and fire employees. This reluctance to expand workforces in a complex regulatory environment contributes to the high rate of unemployment.

- Policy Gridlock and Ideological Constraints: The government’s policy-making process has often been characterized by internal divisions and a reluctance to embrace private sector solutions. An ideological attachment to state-led development, even when state-owned enterprises are failing, has hampered progress and prevented the adoption of more pragmatic and effective approaches.

- Spatial Inequality: The physical layout of South Africa’s cities, a direct legacy of apartheid, creates a significant barrier to economic inclusion. The high cost of transport from townships to economic centers, as highlighted by a Harvard Growth Lab report, limits job-seeking opportunities and perpetuates poverty.

Looking Ahead: The Long-Term Economic Outlook for South Africa

The long-term economic outlook for South Africa is a mix of persistent challenges and cautious optimism. The current trajectory points to continued low-growth in the near term, with forecasts for annual GDP growth remaining below 2% for the next several years. However, this outlook is not set in stone and is highly dependent on the government’s ability to implement critical structural reforms with speed and consistency.

A positive shift in the long-term outlook would require:

Effective Reform of SOEs: The government’s recent moves to open up the electricity market to private producers and implement reforms at Eskom are a positive step. If these reforms are successful and lead to a stable power supply, it could be a significant catalyst for growth, unlocking a huge amount of latent economic potential.

Infrastructure Investment: A focused, well-managed plan to rebuild the country’s dilapidated rail and port systems, potentially in partnership with the private sector, would lower the cost of doing business and enhance export competitiveness.

Improved Governance and Accountability: A sustained effort to professionalize the public administration, combat corruption, and ensure policy predictability is essential to restore investor trust and attract the capital needed for economic expansion. This requires political will and a firm commitment to the rule of law.

Fiscal Discipline and Prudent Management: Stabilizing the government’s debt-to-GDP ratio and ensuring that public spending is effective and targeted towards growth-enhancing initiatives is crucial for long-term fiscal health. This means making tough choices about where to allocate resources and reducing wasteful expenditure.

Targeted Labor and Education Reform: Addressing the skills mismatch through reforms in education and vocational training is vital. Simultaneously, a re-evaluation of labor market regulations to foster greater flexibility could stimulate job creation, particularly within the SME sector.

While the journey will be challenging, the successful implementation of these comprehensive reforms could unlock South Africa’s potential, moving its economy from a state of stagnation to a path of sustainable and inclusive growth. For business leaders, this period presents both risks and opportunities. The risks are clear in the current operating environment, but the opportunities lie in being part of the solution, whether through private sector investment in infrastructure, leveraging new technologies to bypass state failures, or advocating for the necessary policy changes that will ultimately benefit the entire nation. The future of South Africa’s economy depends on a shared commitment from government, business, and civil society to build a more competitive and prosperous future.