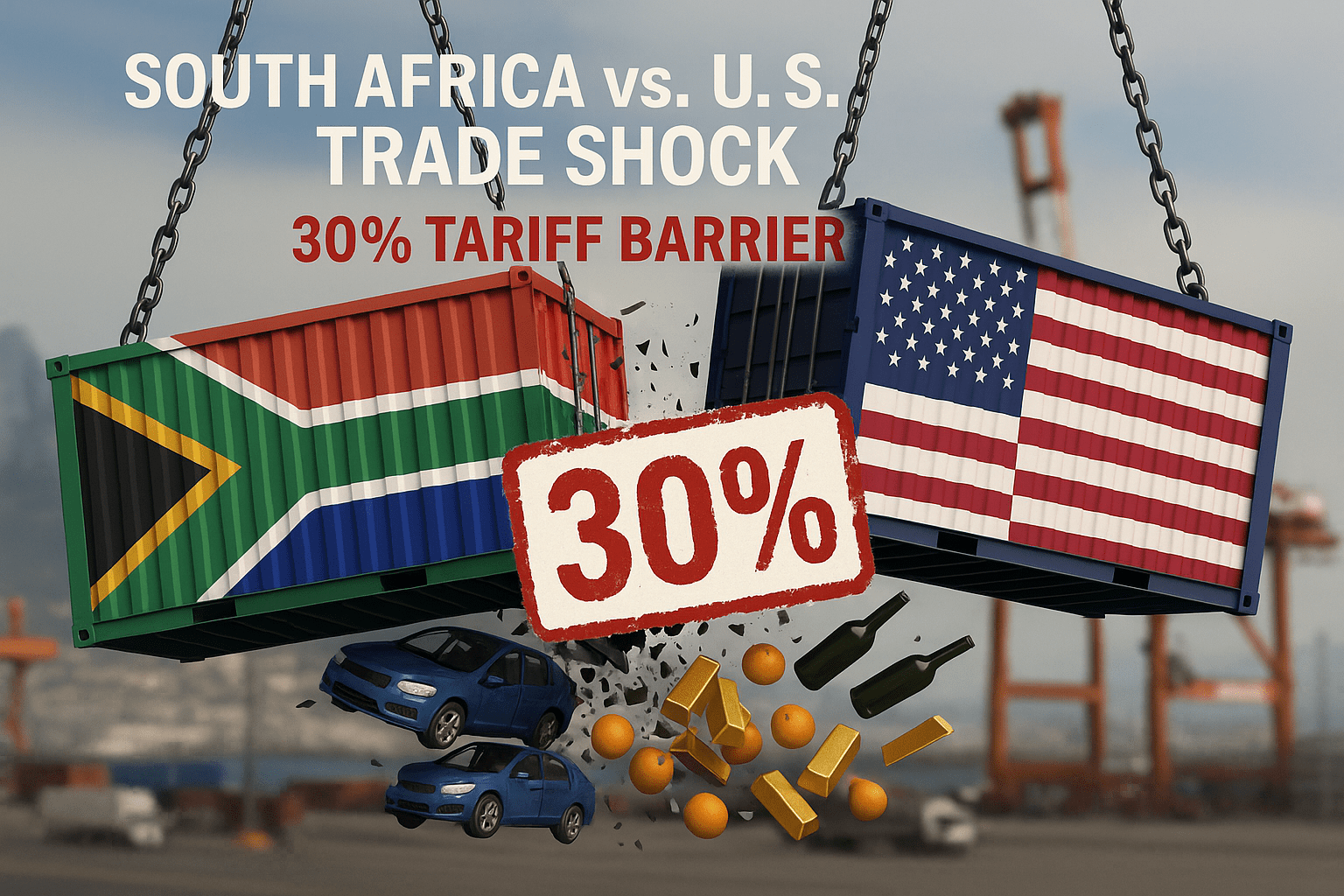

🇿🇦 The 30% Tariff on South African Goods: What It Means for the Country’s Economy, Jobs, and Trade Future

The 30% Tariff on South African Goods

South Africa woke up to a harsh new trade reality today: the United States has officially slapped a 30% tariff on all South African goods entering its borders. This isn’t just a minor policy shift — it’s a dramatic escalation in global trade tensions with direct consequences for South Africa’s economy, its exporters, and everyday citizens.

This news means that the 30% Tariff will have significant implications for trade agreements.

The impact of the 30% Tariff will be felt across numerous sectors.

For many South Africans, the news landed like a punch. Exporters are bracing for cancelled orders, investors are watching the rand tumble, and policymakers are scrambling to contain the fallout. But to understand the full weight of this development, we need to ask: how did we get here, what’s at stake, and where does South Africa go from here?

The administration has justified the 30% Tariff as a necessary measure for economic reform.

Why the U.S. Imposed the Tariff

While official reasons from Washington point to “trade imbalances” and “reciprocal fairness,” most analysts agree that this 30% tariff has more to do with geopolitical signalling than economic math.

The U.S. administration has made it clear that it wants more favourable terms from its trading partners — especially those seen as leaning too close to China or not offering equal access to their own markets. South Africa, as a BRICS member and a vocal non-aligned state in global conflicts, has found itself in the crosshairs.

Understanding the 30% Tariff is crucial for those involved in international trade.

But politics aside, the economic consequences are swift and concrete.

What the Tariff Covers — and Why It Hurts

This 30% blanket tariff affects all South African exports to the United States, unless exempted under special conditions. That includes:

Automotive exports (BMW, Mercedes-Benz, Ford components)

Agricultural goods (wine, citrus, nuts, beef)

Metals and minerals (platinum, gold, iron ore)

Manufactured goods (machinery, textiles, electronics)

The 30% Tariff will impact pricing strategies for South African exporters.

What this means in practice is simple: a South African product that cost $100 yesterday now costs an American buyer $130. That’s a death sentence in a competitive global market.

The Economic Impact: Exports, Jobs, and the Rand

Many industries are now reassessing their operations due to the 30% Tariff.

Exports Will Take a Hit

The U.S. is one of South Africa’s largest export destinations. In 2024 alone, South Africa exported over R140 billion worth of goods to the United States. A 30% tariff makes many of those goods instantly uncompetitive — especially in sectors like citrus, wine, and automotive manufacturing, where margins are already razor-thin.

The 30% Tariff is expected to lead to higher consumer prices in South Africa.

Exporters are expected to pull back production, delay shipments, or cancel new investments altogether.

In this context, the 30% Tariff is a subject of intense debate among economists.

Thousands of Jobs at Risk

Furthermore, reactions to the 30% Tariff vary significantly across sectors.

Entire communities in provinces like the Eastern Cape, Limpopo, and Western Cape rely on exports to the U.S. for their livelihoods. Automotive assembly lines, fruit-packing plants, and export-grade farms are all now at risk of downsizing — or worse, shutting down.

Estimates suggest up to 100,000 direct and indirect jobs could be affected in the short to medium term.

The Rand Will Feel the Heat

The 30% Tariff’s implications extend beyond immediate trade effects.

To mitigate the effects of the 30% Tariff, collaborative efforts are needed.

With export revenue expected to drop and foreign investor sentiment turning negative, the rand has already started to slide. A weaker currency makes imports more expensive, pushing up fuel prices, food costs, and inflation across the board — a particularly painful blow for low-income households.

Domestic Pressure Mounts on Government

The tariff places enormous pressure on the South African government. President Cyril Ramaphosa’s administration is now caught in a political and economic tightrope:

- Should it retaliate with tariffs of its own?

- Should it pursue quiet diplomacy behind closed doors?

- Or should it focus on cushioning the blow domestically with support for affected industries?

Whatever the answer, time is of the essence. Farmers, factory owners, and trade unions are already demanding action.

What About AGOA?

One of the biggest risks looming in the background is the possible collapse of South Africa’s participation in AGOA — the African Growth and Opportunity Act, a U.S. trade programme that gives select African countries duty-free access to American markets.

Losing AGOA status would not only cement the new 30% tariff regime but also send a dangerous signal to investors that South Africa is slipping out of favour with the West.

For now, AGOA technically remains in place. But if political relations continue to sour, that may change quickly.

Can South Africa Bounce Back? Potential Responses

This isn’t the first time South Africa has faced an external economic shock, and it likely won’t be the last. The country has options — but each comes with trade-offs.

Diversify Export Markets

One path forward is to reduce dependency on the U.S. market by increasing trade with:

- The EU

- China and India

- The rest of Africa (through the African Continental Free Trade Area — AfCFTA)

However, building new trade relationships takes time. Logistics, regulatory standards, and pricing all vary, and South African producers can’t pivot overnight.

Support Affected Sectors

The government could introduce targeted relief in the form of:

- Export incentives

- Tax breaks for exporters

- Wage subsidies to prevent job losses

- Assistance in finding new buyers or retooling production for different markets

But with fiscal space already tight, such interventions would require reprioritising the national budget — a tough political sell.

Reopen Negotiations

Diplomatic efforts are underway to seek tariff waivers or revisions. Trade envoys have already begun engaging U.S. counterparts, and there’s a narrow window for a negotiated resolution.

The challenge is finding common ground without looking like South Africa is compromising its foreign policy independence — a balance that’s easier said than done.

In the face of the 30% Tariff, industries must adapt quickly.

The reactions to the 30% Tariff could redefine South African trade policies.

A Turning Point for SA’s Trade Future

This tariff shock could be the wake-up call South Africa needs to overhaul its trade strategy. For too long, the country has relied heavily on a few key markets and raw material exports. Now, there’s an opportunity — albeit a painful one — to:

- Move up the value chain (export finished goods instead of raw commodities)

- Forge stronger regional trade networks in Africa

- Invest in industrial policy that supports local innovation, not just resource extraction

Crisis or Catalyst?

South Africa’s response to this challenge will shape its economic future for years to come.

This could go down as a moment of severe economic disruption — or it could be the start of a new chapter where the country shifts from reacting to external shocks to building resilience and setting its own trade agenda.

Ultimately, the 30% Tariff represents a critical juncture for the economy.

Either way, the coming months will be decisive. Exporters are watching. Investors are watching. And so is the rest of the world.