The Cost of Starting a Business in South Africa vs. Other African Markets

The Cost of Starting a Business in South Africa vs. Other African Markets

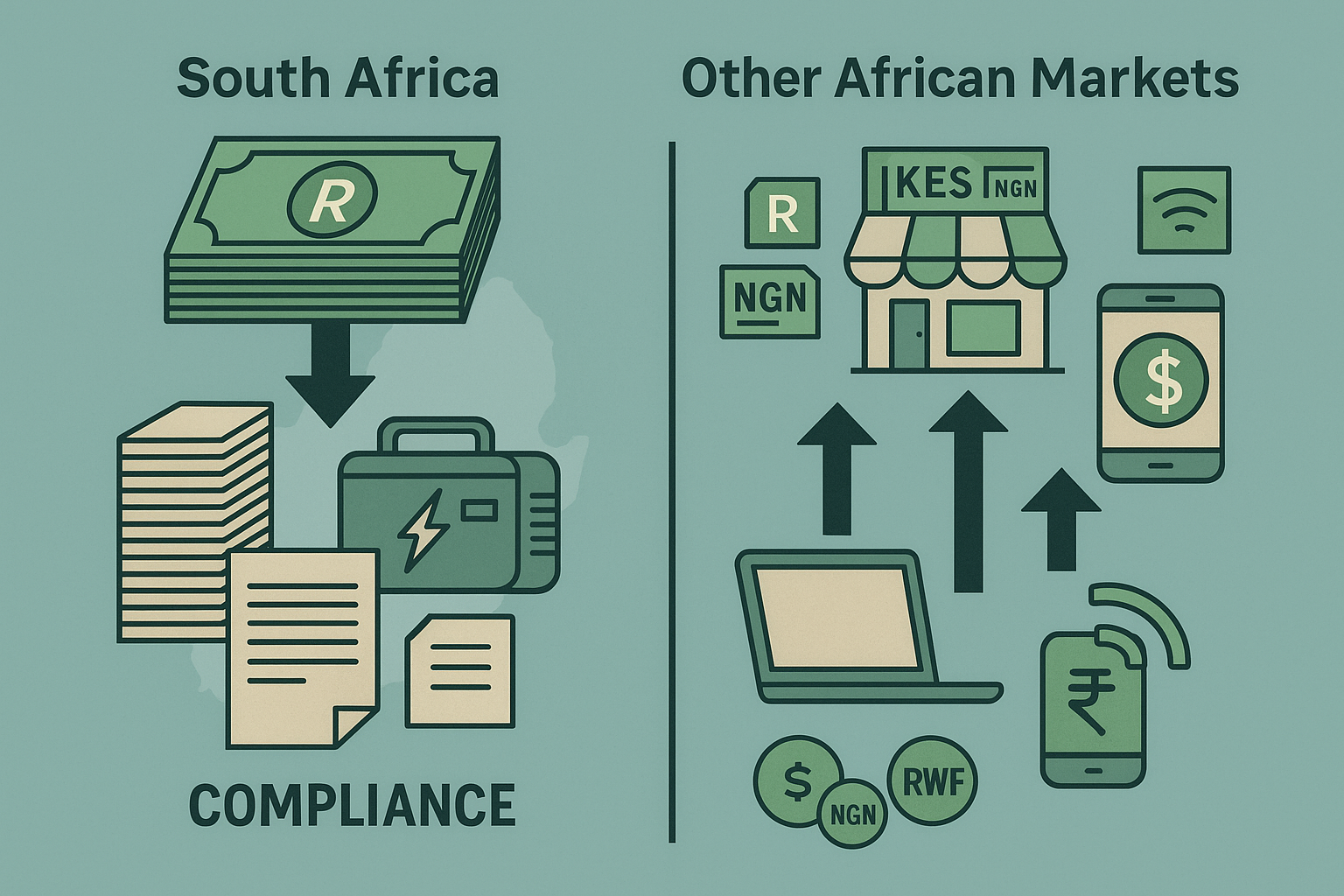

South Africa has long been considered the gateway to African business, but rising costs and bureaucratic hurdles are pushing entrepreneurs to look elsewhere. While the country still offers sophisticated financial markets and infrastructure, the cost of starting a business here has become increasingly high compared to other African markets.

The numbers tell a sobering story. According to the World Bank’s Doing Business rankings, South Africa ranks 84th globally for ease of doing business, trailing behind Rwanda (38th), Kenya (56th), and even Nigeria (131st) in certain key areas. But rankings only tell part of the story – the real costs and barriers facing entrepreneurs reveal why many are choosing to establish their ventures in other African markets.

The True Cost of Starting a Business in South Africa

Registration and Legal Costs

Starting a business in South Africa involves multiple regulatory bodies and significant upfront costs. The basic company registration through the Companies and Intellectual Property Commission (CIPC) costs R175 for a private company, but this is just the beginning.

Legal fees for proper company setup typically range from R8,000 to R15,000, depending on the complexity of the business structure. Add professional accounting services for tax registration, VAT registration, and compliance setup, and entrepreneurs face initial costs of R20,000 to R30,000 before opening their doors.

The process involves multiple steps across different government departments. SARS registration for tax purposes, UIF registration for unemployment insurance, and various municipal licenses create a web of bureaucracy that can take 40-60 days to complete, even with professional assistance.

Ongoing Compliance Burden

The real cost shock comes from ongoing compliance requirements. South African businesses face some of the most complex tax and regulatory environments on the continent. Monthly accounting costs for a small business typically range from R3,000 to R8,000, with annual compliance costs including audits, tax returns, and regulatory filings adding another R15,000 to R50,000 annually.

BEE compliance adds another layer of complexity and cost. While not mandatory for all businesses, companies seeking government contracts or large corporate clients must navigate complex BEE scorecards, often requiring specialist consulting services costing R25,000 to R100,000 annually.

Labour law compliance presents additional challenges. The Labour Relations Act, Basic Conditions of Employment Act, and Employment Equity Act create a complex regulatory framework that requires ongoing legal and HR support, adding R5,000 to R15,000 monthly for growing businesses.

Infrastructure and Operational Costs

South Africa’s infrastructure challenges translate directly into higher operational costs. Load-shedding has made backup power systems essential, with solar installations and generators adding R50,000 to R200,000 to startup costs depending on business size.

Internet connectivity costs remain high compared to other African markets, with business fiber connections costing R2,000 to R8,000 monthly. Office rental in major cities averages R120 to R250 per square meter in business districts, significantly higher than comparable locations in Kenya or Nigeria.

Kenya: The Regional Startup Darling

Streamlined Business Registration

Kenya has transformed its business registration process through digital innovation. The eCitizen platform allows entrepreneurs to register a business in as little as 24 hours for approximately $50 (R950). The entire process can be completed online without requiring physical visits to government offices.

The Kenya Revenue Authority has integrated tax registration into the business registration process, eliminating the need for separate applications across multiple agencies. This streamlined approach reduces both time and costs, with total setup costs typically under R5,000 for basic business registration.

Supportive Regulatory Environment

Kenya’s regulatory environment actively supports entrepreneurship. The government has implemented several initiatives to reduce bureaucratic barriers, including the Single Business Permit that consolidates multiple licenses into one application process.

The country’s mobile money infrastructure, led by M-Pesa, has created an ecosystem that reduces banking costs and simplifies financial transactions for small businesses. Transaction costs are significantly lower than traditional banking, with mobile money transfers costing as little as R5 compared to R50-100 for bank transfers in South Africa.

Lower Operational Costs

Office rental in Nairobi averages $8-15 per square meter monthly (R150-285), significantly lower than Cape Town or Johannesburg. Internet connectivity costs are also lower, with business connections available from R800 monthly for comparable speeds.

Kenya’s stable electricity supply eliminates the need for expensive backup power systems that have become essential in South Africa. While the country still experiences occasional outages, they’re infrequent compared to South Africa’s scheduled load-shedding.

Nigeria: Africa’s Largest Market

Market Size Advantage

Nigeria’s 220 million population creates the largest domestic market in Africa, attracting entrepreneurs despite regulatory challenges. The Consumer goods market alone is worth over $100 billion, offering opportunities that can justify higher operational costs.

Business registration in Nigeria has improved significantly through the Corporate Affairs Commission’s online portal. Companies can now be registered in 24-48 hours for approximately $200 (R3,800), though additional permits and licenses can add to costs.

Fintech and Digital Innovation

Nigeria’s fintech sector has exploded, creating opportunities for entrepreneurs in digital payments, lending, and financial services. The Central Bank of Nigeria’s supportive stance toward financial innovation has created a more favorable environment for fintech startups than South Africa’s more conservative regulatory approach.

The country’s Payment Service Banks license allows smaller players to provide basic banking services without the capital requirements of traditional banks, creating opportunities for innovative financial service providers.

Challenges and Costs

Nigeria’s business environment isn’t without challenges. Infrastructure deficits mean most businesses require generators, adding R30,000 to R150,000 to startup costs. Internet connectivity can be unreliable, though improving rapidly in major cities.

Corruption remains a significant concern, with informal payments sometimes required to expedite permits and licenses. While the government has made efforts to combat this, it remains a factor in business planning and costs.

Rwanda: The Efficiency Champion

World-Class Business Environment

Rwanda consistently ranks as one of Africa’s easiest places to do business. Company registration takes just 4.5 hours and costs approximately $35 (R665). The entire process is conducted through the Rwanda Development Board’s online platform, eliminating bureaucratic delays.

The country has implemented a one-stop-shop approach for business licenses, allowing entrepreneurs to obtain all necessary permits through a single application process. This efficiency extends to tax registration, which is automatically processed during company registration.

Government Support for Entrepreneurs

Rwanda’s government actively supports entrepreneurship through various initiatives. The Rwanda Development Board provides dedicated support for investors, including assistance with permits, land acquisition, and regulatory compliance.

The country offers attractive tax incentives for businesses, including a 0% corporate tax rate for the first two years of operation in certain sectors. Manufacturing companies can qualify for up to 7 years of tax holidays, significantly reducing operational costs.

Limitations and Considerations

Rwanda’s smaller market size (13 million people) limits domestic growth opportunities compared to South Africa’s 60 million. However, the country’s strategic location and excellent infrastructure make it an attractive base for companies targeting the broader East African market.

English proficiency is growing but remains limited compared to South Africa, potentially creating communication challenges for international businesses. However, the government’s focus on English education is rapidly addressing this issue.

Why Entrepreneurs Are Looking Elsewhere

Regulatory Burden vs. Business Support

South Africa’s complex regulatory environment often feels punitive rather than supportive. While the country has sophisticated legal and financial systems, the compliance burden can consume 20-30% of a startup’s time and resources in the first year.

Other African markets have prioritized creating entrepreneur-friendly environments. Rwanda’s one-stop-shop approach and Kenya’s digital-first strategy demonstrate how governments can facilitate rather than hinder business creation.

Speed to Market

In fast-moving technology sectors, the ability to launch quickly can determine success or failure. South Africa’s 40-60 day registration process contrasts sharply with Rwanda’s 4.5-hour timeline or Kenya’s 24-hour online registration.

This speed advantage extends beyond registration to ongoing operations. Obtaining permits, licenses, and regulatory approvals in other African markets often takes weeks rather than months.

Cost of Capital and Access to Funding

While South Africa has more developed capital markets, the cost of capital for startups remains high. Interest rates on business loans average 12-18%, compared to 8-14% in Kenya and similar rates in Rwanda for supported businesses.

Government support programs in other African markets often provide better access to funding. Rwanda’s Business Development Fund and Kenya’s various startup support programs offer more accessible financing options than South Africa’s complex funding landscape.

Infrastructure and Operational Efficiency

Load-shedding has fundamentally changed business planning in South Africa. The need for backup power systems, adjusted operating hours, and productivity losses from power outages add significant costs that don’t exist in other African markets.

Kenya’s reliable electricity supply and Rwanda’s almost 100% electricity access rate eliminate these concerns, allowing businesses to focus on growth rather than basic operational challenges.

The Broader Implications

Brain Drain and Capital Flight

South Africa’s challenging business environment contributes to both brain drain and capital flight. Entrepreneurs who might have started businesses locally are establishing operations in other African markets, taking their skills and capital with them.

This trend extends beyond individual entrepreneurs to established companies. Several South African businesses have relocated their headquarters or primary operations to other African markets, citing regulatory burden and operational costs.

Regional Competition

Other African markets are actively competing for investment and entrepreneurship. Rwanda’s “Ease of Doing Business” reforms and Kenya’s Silicon Savannah initiative demonstrate how countries can create competitive advantages through policy and infrastructure investment.

South Africa risks losing its position as the continent’s business hub if current trends continue. The country’s advantages in financial services, logistics, and professional services may not offset the disadvantages of high costs and regulatory complexity.

Looking Forward: What Needs to Change

Regulatory Reform

South Africa needs comprehensive regulatory reform that prioritizes business creation over bureaucratic process. This includes consolidating licenses and permits, digitalizing government services, and reducing compliance burden for small businesses.

The success of other African markets demonstrates that maintaining regulatory standards doesn’t require complex bureaucratic processes. Technology can streamline compliance while maintaining oversight and control.

Infrastructure Investment

Addressing load-shedding and improving digital infrastructure must be priorities. Businesses cannot compete internationally while dealing with regular power outages and high connectivity costs.

Government investment in renewable energy and digital infrastructure could restore South Africa’s competitive position while supporting long-term economic growth.

Competitive Positioning

South Africa must recognize that it’s competing with other African markets for entrepreneurship and investment. The country’s advantages in education, financial services, and infrastructure won’t automatically translate to business success if the regulatory environment remains challenging.

The choice for entrepreneurs is becoming clear: sophisticated markets with high barriers to entry, or emerging markets with supportive business environments and lower costs. South Africa’s future prosperity depends on which path it chooses to emphasize.

The cost of starting a business in South Africa has become more than just a financial calculation – it’s a strategic decision about where to build the next generation of African businesses. Until South Africa addresses its regulatory complexity and operational costs, entrepreneurs will continue looking elsewhere for opportunities that other African markets are eager to provide.